In its most current economic forecast, the National Australia Bank (NAB) highlighted the major themes and obstacles influencing Australia's economic future. This thorough review looks at the economy's present status, including inflation, labor market developments, GDP growth, and the factors at work globally. NAB's perspective, which strikes a balance between cautious optimism and a realistic understanding of the difficulties that lie ahead, provides insightful information for businesses, governments, and regular Australians.

A Quick Look at GDP Growth

Strong labor market performance and modest salary gains have supported domestic consumption's rise as a key growth engine. With international borders reopening, local economies are being revitalized, especially in the tourist and hospitality industries. The NAB's forecast emphasizes the fine balance between these forces of good and the obstacles that can restrain development, such tighter monetary policy and pressures from the global economy.

Resilience in the Labor Market: A Foundation of Power

The question of wage increase is still crucial. NAB forecasts increased pressure as companies vie for talent in a competitive labor market, despite the fact that salary increases have been modest thus far. Policymakers face a difficult balancing act since this tendency is expected to boost consumer spending even more while simultaneously raising inflationary pressures.

Inflation: A Significant Obstacle

The housing market is already feeling the effects of increasing interest rates, as rising mortgage costs and decreased affordability are causing prices to fall. As price growth slows, this presents chances for first-time purchasers to enter the market, but it also presents issues for current homeowners and investors.

International Factors Affecting the Australian Economy

The major focus is still China, Australia's biggest commercial partner. Despite China's post-pandemic recovery taking longer than anticipated, there is still a high demand for Australian commodities, especially LNG and iron ore. NAB cautions that a protracted slowdown in Chinese development may have an impact on Australia's economy, especially in industries that rely heavily on exports.

The world economy is becoming more complicated as a result of tightening monetary policies in developed nations like the US and Europe. Australia faces both possibilities and problems as a result of these changes, which have an impact on international investment and trade patterns.

Sectoral Highlights: Growth Prospects

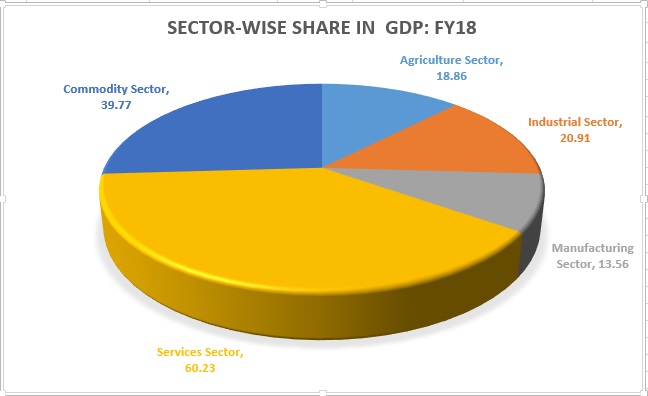

1. Mining and Resources: Australia's mining industry is nevertheless supported by high commodity prices and steady worldwide demand. A move toward sustainable growth is also seen in the growing interest in essential minerals and renewable energy initiatives.

2. Agriculture: Strong development in the agriculture sector is being driven by favorable weather and a high demand for Australian goods worldwide. NAB points out that as global food security becomes importance, there is room for more expansion in export markets.

3. Innovation and Technology: Thanks to developments in fields like artificial intelligence, cybersecurity, and finance as well as digital transformation, the tech industry is flourishing. But skill shortages continue to be a problem, highlighting the necessity of funding education and training.

4. Tourist and Hospitality: Australia's tourism and hospitality industries have been revivified by the reopening of international borders. Regional economies are benefiting greatly from the increase in inbound tourism, which is also generating new job possibilities.

4. Tourist and Hospitality: Australia's tourism and hospitality industries have been revivified by the reopening of international borders. Regional economies are benefiting greatly from the increase in inbound tourism, which is also generating new job possibilities.

Dangers Ahead

- Global Uncertainty: Global commerce and investment are seriously threatened by supply chain interruptions and geopolitical instability.

- Climate Change: Industries like agriculture and tourism may be impacted by extreme weather events and long-term environmental issues, necessitating more adaptability and resilience.

- Cost of Living Pressures: Rising interest rates and high inflation are putting a strain on household finances, which may reduce consumer confidence and spending.

- Dynamics of the Housing Market: A more severe than anticipated drop in housing costs can have wider economic repercussions, impacting consumer spending and wealth accumulation.

The Function of Strategy and Policy

Companies also have a part to play. Businesses may put themselves in a position to prosper in a changing economic environment by embracing innovation, making investments in personnel development, and adjusting to shifting market conditions. In order to solve common issues and open up new opportunities, cooperation between the public and private sectors will be essential.

A Way Ahead

A complex picture of Australia's economic prospects is presented by the National Australia Bank's economic forecast. Despite the country's many obstacles, such as inflationary pressures and international unpredictability, sound fundamentals offer a strong basis for expansion. Strong export industries, resilient labor markets, and a dedication to sustainability and innovation are important cornerstones sustaining Australia's economic development.The lesson is obvious for individuals, companies, and policymakers: handling the complexity of the present economic climate will need strategic forethought and flexibility. NAB's observations provide a useful blueprint for taking advantage of possibilities and reducing risks as Australia navigates a time of profound change.

In end, the National Australia Bank's economic forecast highlights the durability and potential of the Australian economy, despite the fact that there are still many unknowns. Australia can keep creating a rich and sustainable future for all by taking on obstacles head-on and seizing opportunities.