Investment applications and platforms have made it easier than ever to manage and increase your money in the fast-paced world of today. From the convenience of their cellphones, these technologies enable users to manage their portfolios, invest, and gain knowledge of financial markets. As 2025 draws near, let's examine some of the best platforms and applications for investing that may help you accumulate money and safeguard your financial future.

1. Robinhood: A Simple Way to Invest

According to financial expert Sarah Greene, "Robinhood has transformed the way we invest, making financial markets accessible to everyone."(alert-success)

In 2025, consumers will be able to make well-informed judgments because to new features including enhanced instructional content and sophisticated analytics.

2. Acorns: Use Spare Change to Invest

Acorns provides a creative solution for people who find it difficult to save. Acorns makes investing simple by rounding up your regular purchases to the closest dollar and investing the extra change.

"Change starts with little steps. This is demonstrated by Acorns, which transforms everyday routines into lasting riches, according to personal finance blogger John Miller.(alert-success)

Acorns remains the preferred app for passive investors because to its varied portfolios and automatic investment.

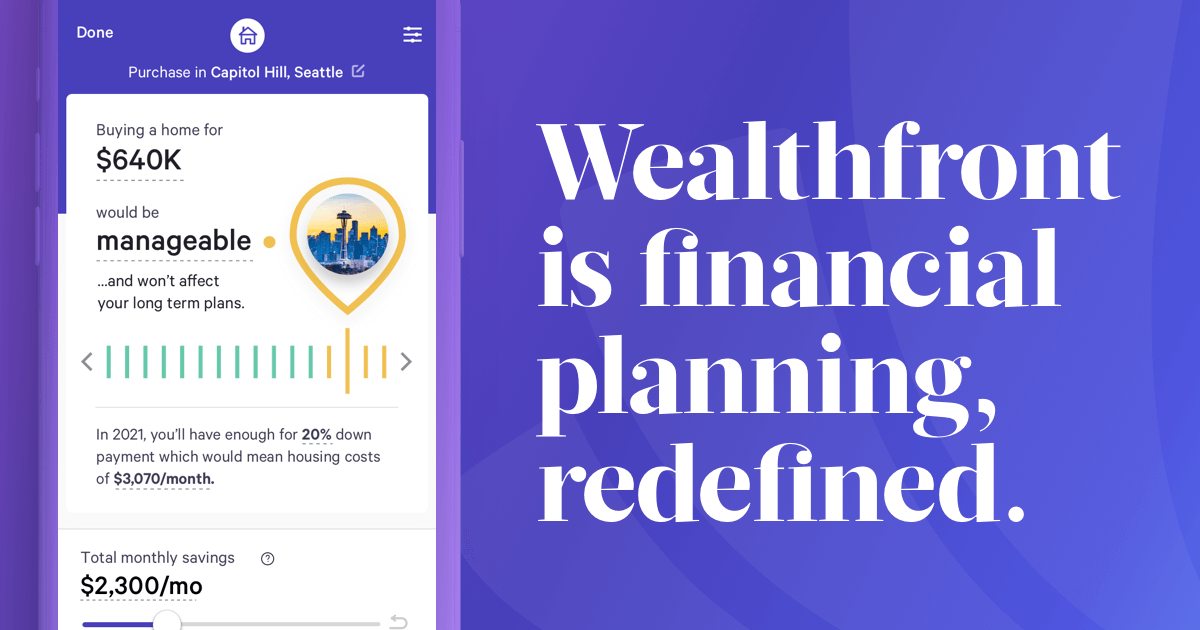

3. Wealthfront: Financial Planning That Is Automated

"Wealthfront offers the ideal balance of automation and customization," says certified financial adviser Maria Lopez.(alert-success)

For those seeking to optimize profits while reducing tax obligations, its goal-setting and tax-loss harvesting features are priceless.

4. E*TRADE: An All-Inclusive Platform

According to market analyst David Chen, "E*TRADE caters to investors of all levels by combining complexity with simplicity."(alert-success)

E*TRADE will launch improved AI-driven insights in 2025, which will facilitate the identification of market prospects.

5. Improvement: Streamlined Money Management

"Betterment makes complicated financial planning easy," says investment expert Emily Carter.(alert-success)

For people who want to match their money with their principles, the app's socially conscious investing alternatives are ideal.

6. Fidelity Investments: Reliable and Trusted

"Fidelity stands out in the competitive investing industry thanks to its dedication to innovation and client service," says portfolio manager Alex Thompson.(alert-success)

Fidelity will launch new AI-powered tools in 2025 to assist customers in personalizing their investing plans.

7. Public: Socially Informed Investing

According to fintech enthusiast Rachel Kim, "the public transforms investment into a shared endeavor, boosting cooperation and learning."(alert-success)

It is a special platform for Gen Z and young investors because of its social elements and openness.

8. M1 Finance: A Combination Method

According to financial analyst Mark Davies, "M1 Finance enables consumers to take charge of their financial destiny with simplicity and efficiency."(alert-success)

It is a great option for do-it-yourself investors due to its dynamic rebalancing and zero commission methodology.

9. Beyond Investing with SoFi Invest

According to personal finance expert Linda Wong, "SoFi Invest is ideal for those looking for a one-stop shop for all their financial requirements."(alert-success)

In 2025, SoFi launches new instructional materials and broadens its selection of cryptocurrencies.

10. TD Ameritrade: A Tradition of Quality

Greg Harper, an equities strategist, says, "TD Ameritrade continues to be a pioneer in innovation and education."(alert-success)

TD Ameritrade, which debuted in 2025, incorporates AI-powered solutions to streamline portfolio administration.

Why Apps for Investing Are Fundamentally changing

"These platforms remove obstacles and make investing accessible to everybody," says financial educator Jessica Taylor.(alert-success)

Regardless of your level of experience, there is an app designed to meet your demands. These platforms will only get more advanced as technology develops further, providing even more chances to increase your wealth.

Advice on Selecting the Best App for Investing

- Your Financial Objectives: Are you learning to trade, accumulating an emergency fund, or saving for retirement?

- Costs and Costs: To optimize your profits, search for apps with little or no fees.

- Features: Give top priority to features and tools that complement your investing plan.

- Ease of Use: Managing your assets may be made more pleasurable with an intuitive interface.

- Educational Resources: For novices in particular, it is essential to learn while you invest.

FAQ

| Question | Answer |

|---|---|

| What is the best app for beginners? | Robinhood and Acorns are excellent choices due to their simplicity and user-friendly interfaces. |

| Are these apps free to use? | Many apps, like Robinhood and Public, offer free trades, though some have premium features. |

| Can I invest in cryptocurrencies? | Yes, platforms like Robinhood and SoFi Invest offer cryptocurrency investment options. |

| What about socially responsible investing? | Betterment and Public provide options for socially responsible and ethical investing. |

| Do these apps offer educational resources? | Most apps include educational tools; E*TRADE and Fidelity are particularly strong in this area. |

Final Remarks

Investing is a more accessible and interesting world than ever. You may take control of your financial destiny and accomplish your wealth-building objectives with the correct software or platform. Choose the best investing app for you by looking through these top picks for 2025. Keep in mind that this is the ideal moment to begin investing."One step is all it takes to reach financial independence. "Select your platform and move forward right now," suggests financial advisor James Howard.(alert-success)

:max_bytes(150000):strip_icc()/TD_Ameritrade_Recirc-97600f27bf3b427eba91b3218de8038e.jpg)