Trading Strategies for Beginners

1. Being Aware of the Fundamentals of Trading

First, what is trading?

With the goal of turning a profit, trading functions similarly to a digital marketplace where you may purchase and sell assets such as stocks, bonds, cryptocurrencies, and more. The strategy is similar to purchasing low and selling high.Asset Types Traded

A wide range of assets are available for trading, including stocks, which represent a portion of a corporation, commodities, such as gold and oil, currency, or even digital currencies, such as Bitcoin. It's similar to picking out the toppings for your pizza.

Essential Ideas and Words

Learn about phrases like "bull market" (when prices are increasing) and "bear market" (when prices are decreasing) before you go in. You will quickly become an expert trader if you grasp ideas like "long" (buying to sell high) and "short" (selling to buy back lower).2. Establishing Reasonable Objectives

Prior to making your first deal, consider the following:- What do you want to accomplish?

- Do you want long-term growth or short-term gains?

- How much time do you have available to trade?

3. Developing a Trading Plan

Clearly defining goals and tactics

A trading strategy will direct you toward your financial objectives, just like a GPS does. Establish your goals, pick tactics that work for you, and then adhere to them religiously. In trading, consistency is essential.Establishing a Trading Routine and Schedule

Trading success is bred by consistency. Decide on a trading plan that works for you and follow it. Make trading a habit, just like brushing your teeth, whether it's in the mornings with coffee or at night with tea. Trading comes naturally to those who follow a routine.4. Applying Technical and Fundamental Analysis

Yes, the dynamic pair of trading techniques is technical and fundamental analysis. Let's dissect it for you.

Going to understand Basic Analysis

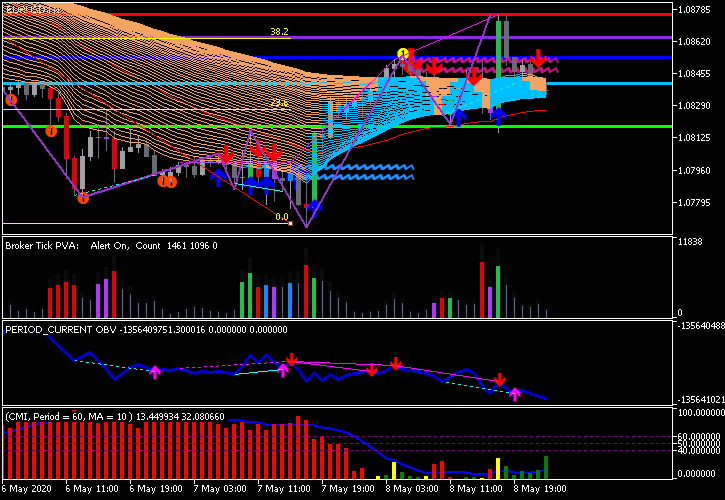

Imagine delving into the specifics of a business's financial situation, industry trends, and economic variables. That's the essence of basic analysis. It's similar to looking into a stock's soul to determine its actual worth.Applying Tools for Technical Analysis

Now, if you were Sherlock Holmes, you would be analyzing market charts and patterns rather than solving murders. For you, that is technical analysis. It entails forecasting future price movements using instruments such as moving averages, support, and resistance levels. Sort of like reading the thinking of the stock market.5. Controlling Emotions and Risk in Trading

Putting Risk Management Techniques into Practice

Consider risk management as a safety net for your trade. You may prevent your hard-earned money from going bankrupt by diversifying your assets, setting stop-loss orders, and carefully sizing your positions.Managing Cognitive Biases and Emotions

Have you ever panic-sold during a market decline or executed a deal out of FOMO (Fear of Missing Out)? We've all been there, yes. Making logical trading judgments requires an awareness of and ability to control these biases and emotions. Breathe deeply; it's only a transaction.6. Developing Patience and Discipline

When it comes to trading, emotions may be your biggest opponent. How to maintain discipline:

The key is to be flexible. Keep a record of your transactions, evaluate what is and is not working, and be prepared to modify your tactics as necessary. To stay ahead of the curve, you must anticipate and adjust, much like in a game of chess. In conclusion, commitment, ongoing education, and a readiness to adjust to changing market conditions are necessary for novice traders to become proficient in trading methods. You may improve your chances of success in the financial markets and provide a solid basis for your trading career by following the instructions in this handbook. Remain disciplined and patient, and constantly assess and modify your tactics as necessary. You may successfully negotiate the challenges of trading and strive toward reaching your financial goals if you are persistent and have a proactive mentality. Have fun trading!

Now that you understand the fundamentals, let's look at some trading tactics that are easy for beginners to use:

- Adhere to your trading strategy.

- Don't chase losses.

- When you're feeling overburdened, take pauses.

- Pay attention to the big picture rather than the day-to-day variations.

7. Assessing and Modifying Your Trading Methods

8. Use a Demo Account to Practice

You may practice trading with virtual money using the demo accounts that the majority of brokers provide. This is a low-risk method of:- Get familiar with the trading platform.

- Try out your tactics.

- Before spending actual money, get confidence.

9. Examining Trading Methods

a) Trading on the Day

Buying and selling on the same trading day is known as day trading. Making money off of little price changes is the aim. To be successful:- Pay attention to assets that are very liquid.

- Charts may be used to spot trends.

- Remain disciplined and refrain from making rash judgments.

b) Trading in swings

Capturing short- to medium-term gains over a few days or weeks is the goal of swing trading. For people who are unable to keep a close eye on the market, this approach is effective. Important advice:- Make use of moving averages and other technical indicators.

- Recognize patterns and reversals.

- Have patience and follow your strategy.

c) DCA, or dollar-cost averaging

Regardless of price, DCA is a long-term technique in which you invest a set sum at regular periods. This approach is perfect for novice stock or cryptocurrency investors since it lessens the effects of market volatility.d) Following Trends

Trading in line with the current market trend is the goal of this technique. You can identify trends with the use of tools like trendlines and moving averages. Until it stops, keep in mind that "the trend is your friend."10. Keeping Up to Date

Making wise trading selections requires being updated about the ever-changing financial markets. Here are some tips for staying current:- Keep up with market news: Get subscriptions to reputable financial news sites such as Reuters, Bloomberg, or CNBC.

- Keep an eye on economic indicators: Pay attention to market-influencing news such as GDP growth, employment statistics, and interest rate announcements.

- Make Use of Trading Platforms: A lot of trading systems offer news and analysis in real time.

- Participate in Virtual Communities: Participate in trading-related forums or social media groups to share ideas and pick the brains of seasoned traders.

- Enroll in educational courses: To learn more about trading tactics and market dynamics, sign up for classes or webinars.

11. Beginning Small and Growing

When you're prepared to use actual money to trade:- Choose a modest starting point that you can afford to lose.

- Prioritize education over generating enormous revenues.

- Increase your money gradually as you become more confident and experienced.